UK Rental Market Update and Forecast

According to Zoopla's latest quarterly rental market report, rising demands in the third quarter of 2021 have driven rental growth to its highest point in 13 years.

UK rents are reportedly rising at an average rate of 4.6% annually, with demand in most major metro areas doubling across the country.

The latest findings from the report are making the headlines, as the UK rental market displays a strong pandemic recovery - but what are the finer details, and where to next? Let's unpack the report and current market conditions further.

UK rental growth at 13-year high

Average UK rents rose by 3% in Q3, and at the end of September, the figures represented a 4.6% increase year-on-year. This growth is driven mainly by strengthening demand across the country - particularly in city centres. When taking London out of the equation, average UK rents are 6% higher year-on-year, representing a 14-year high.

Despite the resumption of a more normal day-to-day life, rental supply remains low, with total stock figures reportedly around 40% lower than the five-year average. This imbalance between demand and supply is putting upward pressure on the market and causing rents to rise.

The South West of England was the region clocking up the fastest rental growth for the quarter, climbing 3.3% in Q3 - up 9% year-on-year. Some South Western areas experienced significant supply pressures as many tenants chose to migrate to coastal and rural locations. During Q3, average letting times were below ten days, and rents in Purbeck, Dorset soared by over 16% year-on-year, taking the top spot for highest UK rental growth for Q3.

Aside from London and Scotland, most regions are at or close to 10-year highs in rental price growth. The report's findings also point to a correlation between rental growth and the relative affordability of a region.

Recovery for London and other city centres in full swing

While London’s rental price growth is lagging somewhat compared to the rest of the UK, the capital’s rental market is still experiencing a boost.

As the capital reopened its doors to leisure, entertainment, and commerce, a distinct rental demand resurgence in Q3 caused rents to increase by 4.7% for the quarter. Rental market activity in London also shot up, with tenancies being agreed at a 50% increased rate when compared to the five-year average.

London's rental prices fell significantly during the lockdowns, so average rents remain 5% lower than pre-pandemic figures, despite a return to growth. But it is expected that demand and rental growth will continue to increase before any significantly heightened supply begins to balance the market.

This rental growth and heightened demand is evident in other major UK cities, too. For example, Birmingham, Manchester, and Leeds saw inner-city rental demands double in Q3 from that of Q1, while Edinburgh witnessed an increase of over 60%. However, growth for the rental sector in outer city zones also remains steady, demonstrating the continued desire for renting properties within wider commuting city areas brought about by Covid-19 and the adoption of remote working.

In the year to September of 2021, the UK city recording the greatest growth rate was Bristol at 8.4%, followed by 83.% for Nottingham, and 7.2% in Glasgow.

Current rental prices in the UK

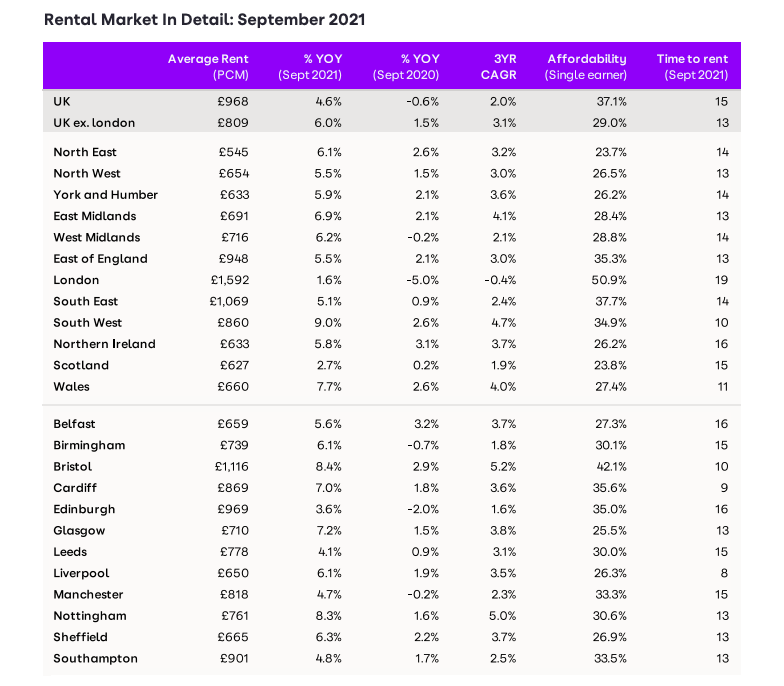

The current monthly average rental prices range from £545 in the North East to £1,592 in London - although boroughs within the capital vary significantly, too. The overall average UK rent is currently £968 per calendar month (PCM), while the average excluding the capital stands at £809 PCM.

Below is a table recently published by Zoopla, breaking down each region and city by average rents, growth rates, activity and affordability.

Image Credit: Zoopla

What about house prices?

Recent headlines of a 33% house price growth forecast sent heads spinning, and while these projections may be a little lofty, continued growth is expected.

Figures published by the Office for National Statistics show that average UK house prices did rise by an average of £25,000 year-on-year in August 2021, with increases occurring in all regions.

Additionally, the rate of inflation reached 10.6% in the same month. This represented a sizable leap from the 8.5% reported for July, and drove average UK property prices to £264,000.

The Bank of England recently announced that interest rates would remain unchanged for now, but that imminent rate rises are to come, as the government seeks to combat the rising rate of inflation and keep the market buoyant.

Given that interest rates will soon begin to rise, buyer demand is expected to cool off. That said, if supply issues continue to haunt the sales market in the same way as the rental sector, prices could continue to edge upwards for some time to come.

The general consensus regarding buying a property is to get in now and secure an affordable fixed interest rate before they begin to climb. The market needs more investors, so if being a landlord is an aspiration, now might be the time to take the leap.

Imbalance of supply and demand to support continued rental growth into 2022

The sudden surge in demand in response to the lockdowns ending eroded already-dwindling rental supplies, and this alone will take some time to recover. That said, a longer-term inventory issue may affect the market for some time to come.

Landlord investment levels have waned since the additional 3% stamp duty was introduced back in 2016. Although there was increased activity in response to the recent stamp duty holiday, it hasn't been significant enough to bridge the gap.

Build-to-rent is gaining more traction, but it represents a relatively small portion of the overall market. The sales sector is in a position to support some upturn in rental supply, as more first-time buyers may jump ship from their rentals and enter the market while the mortgage interest rates remain low.

Nevertheless, the pattern of rental growth is set to continue as supply issues persist for the foreseeable future.

Are you looking to rent out a property in the UK?

We also offer a range of services to help private landlords attract more tenants and get the best possible rental value. Click the links to find out more about advertising on Rightmove for just £1, rent collection, downloading a tenancy agreement, or tenant credit checks and referencing.

Find out how much your property could rent out for in just 60 seconds with our online rent calculator.